Candlestick Cheat Sheet PDF: Your Guide to Smarter Trading

Want to improve your trading and boost your profits? Mastering candlestick charts is a key step. This guide provides a structured approach to using free candlestick cheat sheets, comparing two popular options – ChartGuys and Timon & Mati – and outlining a step-by-step plan for confident candlestick pattern interpretation. We'll explore how to identify reliable signals, mitigate risk, and leverage these visual clues to enhance your trading strategy. For deeper insights into market psychology, check out this helpful resource on market psychology.

Understanding Candlestick Charts: Deciphering Market Sentiment

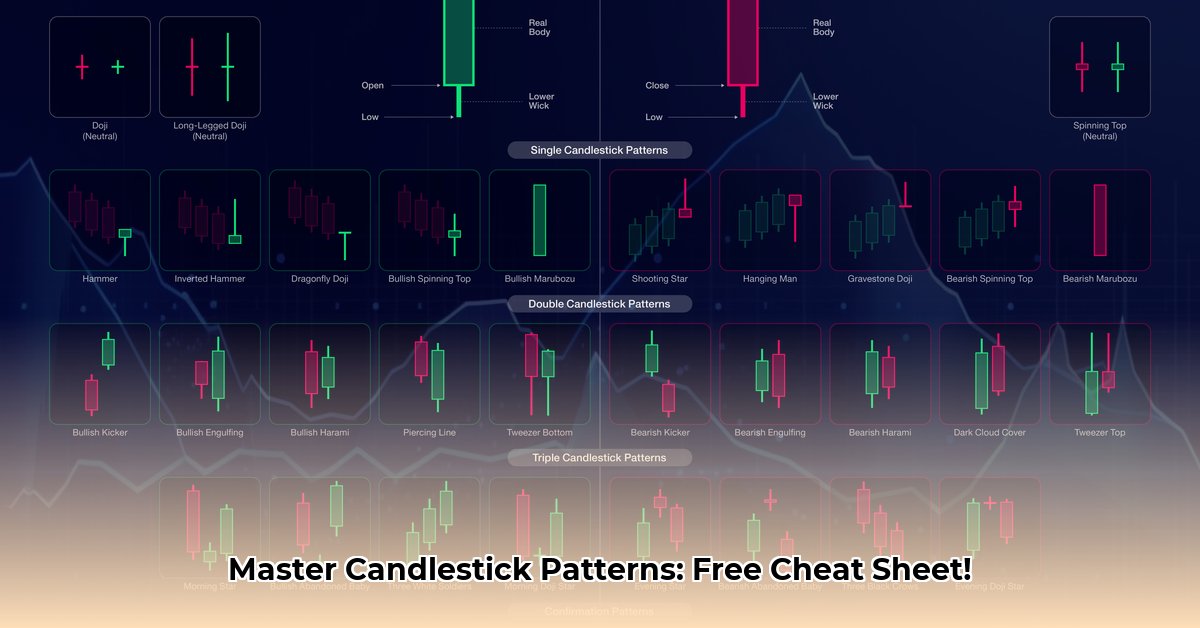

Candlestick charts, while initially appearing complex, represent a concise visual summary of price movements. Each "candle" depicts a specific time period (e.g., a day or an hour), showing the opening, closing, high, and low prices. A tall green candle signifies buyer dominance, pushing prices higher; a red candle indicates seller control, driving prices down. However, the real power comes from recognizing recurring candlestick patterns – combinations of candles that suggest potential future price direction. A reliable candlestick cheat sheet acts as your go-to reference for these patterns. Are you ready to unlock the power of these visual clues?

ChartGuys vs. Timon & Mati: A Comparative Review

Numerous candlestick cheat sheets exist, but this guide focuses on ChartGuys and Timon & Mati. Both offer downloadable PDFs, but their content and target audiences differ significantly.

ChartGuys provides a comprehensive, in-depth guide suitable for advanced traders. It covers a vast array of patterns, including rarer variations, details confirmation methods, and even integrates risk management strategies. It's the ultimate resource for serious traders seeking a deep dive into candlestick analysis.

In contrast, Timon & Mati offers a simpler, beginner-friendly introduction. It focuses on common, easily identifiable patterns, making it ideal for those new to candlestick analysis who want a quick overview. Which approach best suits your current skill level and trading goals?

| Feature | ChartGuys | Timon & Mati |

|---|---|---|

| Pattern Coverage | Extensive; includes less common patterns | Primarily common, easily-spotted patterns |

| Confirmation | Detailed strategies emphasized | Less emphasis on confirmation techniques |

| Risk Management | Integrated into pattern explanations | Minimal risk management discussion |

| User Level | Experienced traders | Beginners |

A Step-by-Step Guide to Mastering Candlestick Patterns

Regardless of your chosen cheat sheet (ChartGuys, Timon & Mati, or another), follow this structured learning path:

Fundamental Patterns: Begin with the most common patterns: the Doji (indicating indecision), the Hammer (a potential reversal signal), and the Shooting Star (another potential reversal, suggesting a price drop). Mastering these is crucial. Have you started practicing these foundational patterns yet?

Chart Practice: Analyze historical stock charts, identifying the patterns you've learned. Consistent practice is key to accurate recognition. Don't become discouraged – proficiency takes time and dedication. How many hours per week are you dedicating to chart practice?

Confirmation is Crucial: Never rely solely on candlestick patterns. Always seek confirmation using additional analytical tools. Consider trading volume, overall price trends, and other technical indicators to reduce the risk of false signals. Does your confirmation strategy include multiple indicators?

Effective Risk Management: Before entering any trade, define your entry and exit points and your maximum acceptable loss. This protects your capital and emotional well-being. What's your typical risk-to-reward ratio?

Advanced Techniques: Once comfortable with fundamental patterns, explore more complex combinations and rarer patterns. However, remember that confirmation remains essential even with advanced formations. Are you ready to expand your knowledge into more complex patterns?

Limitations of Candlestick Analysis: Avoiding Common Pitfalls

Candlestick patterns are not foolproof predictors. They represent probabilities, not certainties. Some patterns are more prone to misinterpretation or false signals than others. This underscores the importance of confirmation and risk management.

| Pattern Type | Potential for Misinterpretation | Likelihood of False Signals | Risk Mitigation Strategies |

|---|---|---|---|

| Basic (Doji, Hammer, Shooting Star) | Moderate | Moderate | Volume analysis; corroborating evidence from other indicators |

| Advanced (Engulfing, Three-Line Strike) | High | Lower | Thorough understanding; backtesting; strict risk management |

Your Path to Profitable Trading

Mastering candlestick patterns, using a reliable cheat sheet, and employing a robust confirmation strategy significantly enhances your ability to analyze market sentiment and make informed trading decisions. But remember: consistent practice, diligent risk management, and a blend of technical and fundamental analysis are crucial for sustainable success in trading. Start your learning journey today!

[1] ChartGuys: Free Candlestick Patterns PDF. ChartGuys. https://www.chartguys.com/articles/free-candlestick-patterns-pdf (Accessed: 2023-10-27)